Pay-as-you-go: 7 Powerful Benefits That Transform Your Spending

Imagine only paying for what you actually use—no hidden fees, no long-term commitments. That’s the magic of pay-as-you-go. This flexible model is reshaping how we manage everything from phones to cloud computing.

What Is Pay-as-you-go and How Does It Work?

The pay-as-you-go model is a pricing strategy where users pay only for the services or products they consume, without upfront costs or fixed subscriptions. It’s a departure from traditional models that lock customers into monthly plans or long-term contracts. Instead, it offers real-time billing based on actual usage.

Core Principles of Pay-as-you-go

At its heart, pay-as-you-go operates on three foundational principles: usage-based billing, instant access, and zero commitment. These principles make it ideal for individuals and businesses seeking flexibility and cost control.

- Usage-Based Billing: Charges are calculated based on actual consumption—like minutes used, data consumed, or computing resources accessed.

- Instant Access: Services are available immediately upon payment, often without credit checks or lengthy sign-up processes.

- No Long-Term Contracts: Users can stop using the service at any time without penalties.

“Pay-as-you-go shifts the power from providers to consumers by aligning cost with actual value received.” — Forbes Technology Council

Historical Evolution of the Model

The concept of pay-as-you-go isn’t new. It dates back to early 20th-century coin-operated telephones and vending machines. However, the digital revolution of the 2000s brought this model into mainstream use, especially in telecommunications and cloud computing.

Mobile networks in Europe and Asia were among the first to popularize prepaid mobile services in the 1990s. As technology advanced, the model expanded into utilities, transportation, and software. Today, companies like AWS and Microsoft Azure use pay-as-you-go pricing for cloud infrastructure, allowing startups to scale without massive upfront investments.

Pay-as-you-go in Telecommunications

One of the most recognizable applications of pay-as-you-go is in the mobile phone industry. Prepaid mobile plans allow users to load credit and use services like calls, texts, and data as needed.

How Prepaid Mobile Plans Work

Users purchase airtime or data bundles from carriers or retailers. This credit is added to their account and deducted as they use services. When the balance runs out, service stops unless more credit is added.

- No credit checks required

- Flexible top-up options (online, in-store, via apps)

- Transparent pricing with no surprise bills

This model is especially popular in emerging markets where many people don’t have bank accounts or credit histories. According to the GSMA, over 1 billion people rely on mobile money services, many of which are built on pay-as-you-go principles.

Advantages Over Postpaid Plans

Compared to postpaid (monthly bill) plans, pay-as-you-go offers greater financial control. Users can’t overspend, which makes it ideal for budget-conscious consumers and parents managing children’s phone use.

- Budget predictability: You only spend what you load.

- No risk of debt: No monthly bills mean no late fees or credit damage.

- Easier access: Available to anyone with cash or digital payment.

However, postpaid plans often include perks like device financing and premium customer support, which pay-as-you-go users may miss out on.

Pay-as-you-go in Cloud Computing and IT Services

The tech industry has embraced pay-as-you-go as a cornerstone of modern cloud infrastructure. Platforms like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure offer granular billing for computing power, storage, and bandwidth.

How Cloud Providers Implement Pay-as-you-go

Cloud services track usage in real time—down to the second or gigabyte. For example, AWS EC2 instances charge per second of runtime, while S3 storage bills per gigabyte stored per month.

- Compute: Pay per virtual machine hour

- Storage: Pay per GB stored

- Data Transfer: Pay per GB uploaded or downloaded

This model allows startups to launch without investing in physical servers. A small app can start on a $5/month server and scale up as demand grows, paying only for what it uses.

Cost Management and Optimization

While pay-as-you-go offers flexibility, it can lead to unexpected costs if not monitored. Many companies use tools like AWS Cost Explorer or Azure Cost Management to track spending.

- Set budget alerts to avoid overages

- Use reserved instances for predictable workloads

- Automate shutdown of unused resources

“The pay-as-you-go model in cloud computing democratizes access to enterprise-grade technology.” — TechCrunch

Pay-as-you-go in Energy and Utilities

Energy providers are adopting pay-as-you-go systems, especially in regions with unreliable grid access or high poverty rates. Smart meters and mobile payments enable users to buy electricity or gas in small increments.

Smart Meters and Prepaid Energy

In countries like Kenya and South Africa, companies like M-KOPA offer solar home systems on a pay-as-you-go basis. Customers make small daily payments via mobile money until the system is fully paid, after which it becomes theirs.

- Reduces energy poverty

- Enables ownership without credit

- Encourages energy conservation

This model has brought electricity to over 1 million homes in East Africa, according to M-KOPA’s 2023 impact report.

Water and Gas Applications

Similar systems are used for water and cooking gas. In India, the government has piloted smart prepaid water meters in urban slums to reduce waste and ensure fair distribution.

- Users pay per liter or per minute of flow

- Remote monitoring prevents tampering

- Reduces non-revenue water loss for utilities

These systems improve efficiency and accountability, benefiting both consumers and providers.

Pay-as-you-go in Transportation and Mobility

The transportation sector has seen a surge in pay-as-you-go models, from ride-sharing to electric scooters and car rentals.

Ride-Sharing and Micro-Mobility

Platforms like Uber, Lyft, and Lime operate on a pay-per-ride basis. Users pay only for the distance and time of their trip, with no membership fees.

- No subscription required

- Dynamic pricing based on demand

- Integrated digital wallets for seamless payment

In cities like Paris and San Francisco, pay-as-you-go e-scooter rentals have reduced car dependency and eased congestion.

Car Leasing and Insurance

Some automakers and insurers now offer pay-as-you-go car leases and usage-based insurance (UBI). For example, Metromile charges drivers per mile driven, ideal for low-mileage users.

- Lower costs for infrequent drivers

- Telematics track driving behavior

- Promotes safer, more efficient driving

According to NHTSA, UBI programs have led to a 20% reduction in claims among participating drivers.

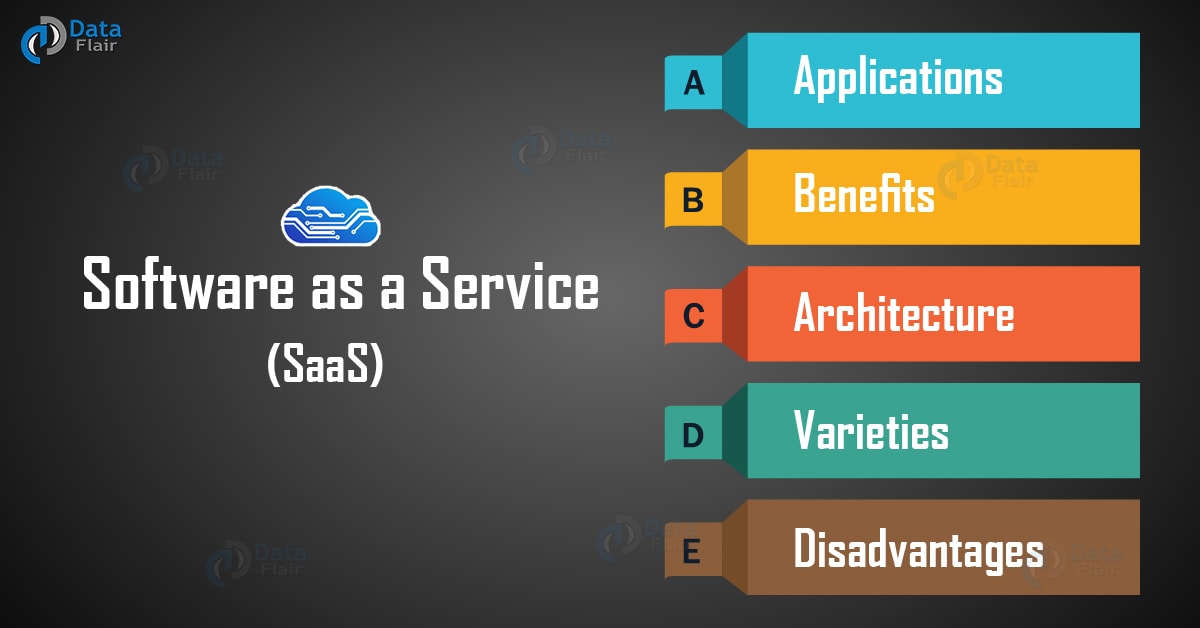

Pay-as-you-go in Software and SaaS

Software as a Service (SaaS) companies are increasingly adopting pay-as-you-go pricing, moving away from flat monthly fees.

Usage-Based Pricing Models

Platforms like Twilio (communications API), Stripe (payments), and Snowflake (data warehousing) charge based on usage metrics such as API calls, transaction volume, or data processed.

- Twilio: Pay per SMS or voice minute

- Stripe: Pay per transaction

- Snowflake: Pay per compute and storage used

This model aligns costs with business growth. A startup sending 100 SMS per month pays far less than an enterprise sending millions.

Benefits for Startups and SMEs

For small businesses, pay-as-you-go SaaS eliminates the need for large software licenses. It allows them to experiment, scale, and innovate without financial risk.

- Low barrier to entry

- Scalable with business needs

- No long-term vendor lock-in

“Usage-based pricing is the future of SaaS. It rewards efficiency and innovation.” — SaaS Capital Report 2023

Pay-as-you-go in Healthcare and Insurance

Even traditionally rigid industries like healthcare are exploring pay-as-you-go models, particularly in telemedicine and wearable-based insurance.

Telemedicine and On-Demand Care

Platforms like Teladoc and Amwell allow users to pay per consultation. There’s no subscription—just a one-time fee for a virtual doctor visit.

- Immediate access to care

- No insurance required

- Ideal for minor illnesses or mental health support

This model is especially valuable in rural areas with limited medical access.

Wearable-Driven Health Insurance

Insurers like John Hancock offer policies where premiums are adjusted based on activity tracked by wearables. The more you walk, the more you save.

- Incentivizes healthy behavior

- Real-time data improves risk assessment

- Users pay only for the coverage they use

While privacy concerns exist, many users appreciate the transparency and control.

Challenges and Risks of Pay-as-you-go Models

Despite its advantages, pay-as-you-go isn’t without drawbacks. Understanding these risks is crucial for both providers and consumers.

Potential for Higher Long-Term Costs

While pay-as-you-go avoids upfront fees, it can be more expensive over time. For example, buying data in small increments often costs more per unit than bulk plans.

- Per-unit pricing is higher

- No volume discounts

- Can discourage heavy usage

Consumers should compare total annual costs before choosing a plan.

Service Interruption Risks

If a user runs out of credit, service stops immediately. This can be problematic for critical services like healthcare or internet access.

- No grace period

- Requires constant monitoring

- Can disrupt business operations

Some providers offer auto-recharge options to mitigate this risk.

Data Privacy and Security Concerns

Pay-as-you-go systems often rely on continuous data tracking, raising privacy issues. Who owns the usage data? How is it stored and shared?

- Providers collect detailed usage patterns

- Risk of data breaches

- Lack of transparency in data policies

Regulations like GDPR and CCPA are helping, but enforcement remains inconsistent.

Future Trends in Pay-as-you-go Services

The pay-as-you-go model is evolving with advancements in AI, blockchain, and the Internet of Things (IoT).

AI-Powered Dynamic Pricing

Artificial intelligence is enabling real-time pricing adjustments based on demand, user behavior, and external factors like weather or traffic.

- Optimizes resource allocation

- Personalizes pricing for users

- Reduces waste in energy and transport

For example, smart grids can offer lower electricity rates during off-peak hours, encouraging users to shift usage.

Blockchain and Micropayments

Blockchain technology allows for secure, low-cost micropayments, making pay-as-you-go feasible for tiny transactions—like paying per article read or per minute of music streamed.

- Enables fractional ownership

- Reduces transaction fees

- Increases transparency

Projects like Brave Browser’s BAT (Basic Attention Token) are already using this model for digital content.

Expansion into New Industries

Pay-as-you-go is moving into education, agriculture, and even housing. Imagine paying per lecture attended or per hour of irrigation used on a farm.

- EdTech platforms offering pay-per-course access

- Smart farming tools with usage-based fees

- Co-living spaces with daily rental options

The possibilities are limited only by imagination and technology.

What is pay-as-you-go?

Pay-as-you-go is a pricing model where users pay only for the services they consume, without fixed subscriptions or long-term contracts. It’s commonly used in telecom, cloud computing, energy, and transportation.

Is pay-as-you-go cheaper than monthly plans?

It depends on usage. For light users, pay-as-you-go can be cheaper and more flexible. For heavy users, monthly subscriptions often offer better value through volume discounts.

Can businesses benefit from pay-as-you-go?

Yes. Businesses, especially startups, benefit from lower upfront costs, scalability, and the ability to align expenses with actual usage, particularly in cloud services and SaaS.

What are the risks of pay-as-you-go?

Risks include higher per-unit costs, service interruptions when credit runs out, and potential data privacy concerns due to constant usage tracking.

How is pay-as-you-go evolving with technology?

It’s being enhanced by AI for dynamic pricing, blockchain for secure micropayments, and IoT for real-time usage monitoring, expanding into new sectors like education and agriculture.

The pay-as-you-go model is more than a pricing strategy—it’s a shift toward user empowerment, financial inclusivity, and resource efficiency. From mobile phones to cloud computing, it’s transforming how we access and pay for services. While challenges like cost predictability and data privacy remain, the benefits of flexibility, transparency, and accessibility are driving its global adoption. As technology evolves, pay-as-you-go will continue to expand into new industries, offering smarter, fairer, and more sustainable ways to consume. Whether you’re a consumer, entrepreneur, or policymaker, understanding this model is key to navigating the future of digital economies.

Further Reading: